INTRO: In The Beginning, We Are All Stick Figures.

Hi, my name is Gianna and I would like to welcome you to my blog. I will be breaking down a multitude of perspectives about the tax system, ranging from my own to those of *a stick figure.

Throughout the many years I have spent at BASIS, I have developed a blossoming interest in the United States’ economic policies. From the Keynesian economic principles used during World War ll to the current Modern Monetary Theory (MMT), the United States has always relied heavily on spending to better our domestic standard of life. While, on paper, this concept sounds fairly reasonable, you may question where our government gets all this spending money. Well, if this question is racking your brain, like it is in mine, you have found the perfect dependent, who still receives a refund on her W-2, to tell you all about the implications and complexities of the tax system.

For the past month, I have been interning at a local Certified Public Accounting firm, where I will continue my main internship. My primary job will be tax processing, and while I am looking forward to learning this new skill, I am even more excited to simply observe the chaotic environment of the firm when tax season rolls around. I think this experience will clue me in on all the steps required to develop just one tax report. On top of gaining this insider perspective, I will be creating a podcast in which I will interview different business owners, medical facilities, non-profit corporations, and accountants. I chose to take on this additional task because I want to hear the start-up stories of local businesses and get a better understanding of how much the general population knows about the taxes they are filing. This topic is rather fascinating because taxes are arguably the backbone of our society. However, a minute portion of our population can even explain the ancient machine that is the progressive tax system. With this internship and these interviews, I will be able to examine if the concept of dealing with taxes is enough to hinder the economic prosperity of certain businesses and therefore is the “Sword of Damocles” to our economy.

I hope you all will enjoy this turbulent journey as much as I will.

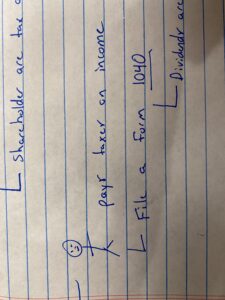

*Below is a picture my mentor drew for me using a stick figure to represent business owners attempting to tackle taxes to convey the basic inner workings of the tax system.