Projecting the Future of the World Bank

Akhil D -

Hey everyone! Today I wanted to walk you through a projection I did on International Development Association (IDA), one of the World Banks’s development arms. The method I used is similar to a Discounted Cash Flow (DCF) analysis. In a DCF, you estimate the value of an investment based on its expected future cash flows, discounted back to their present value.

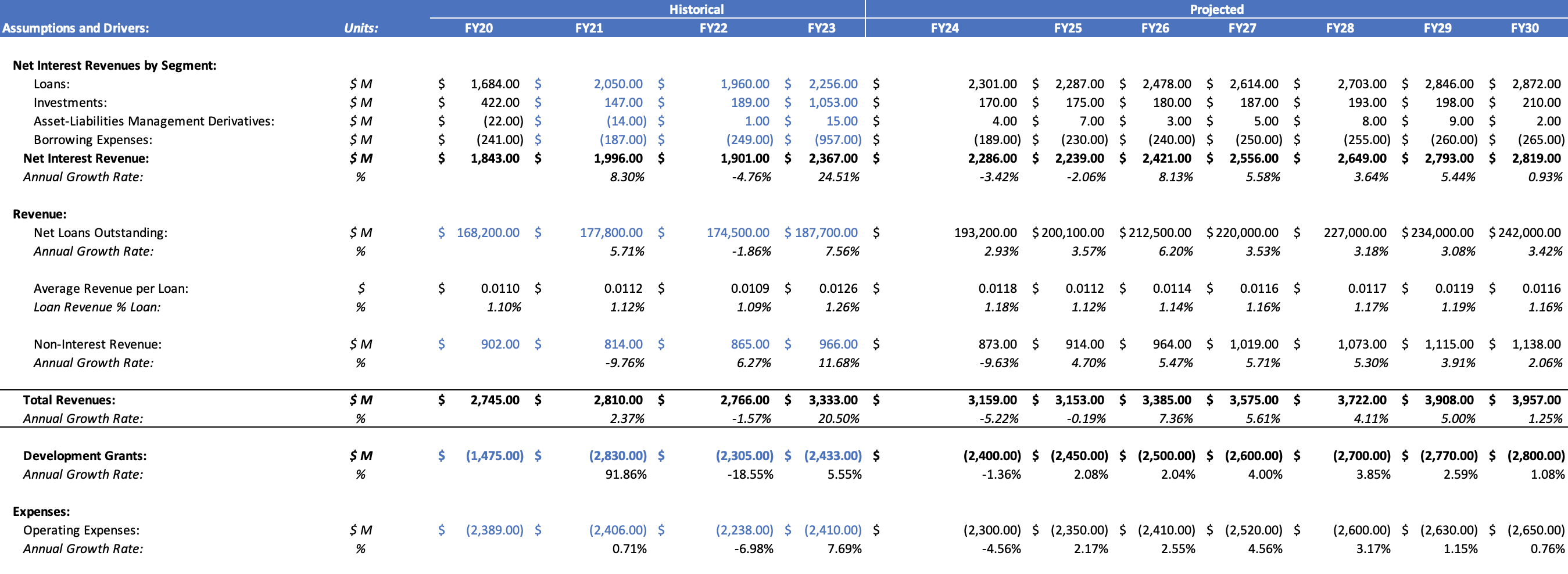

To start off, I outlined some assumptions.

Then I looked into the IDA’s financial statements to find and project the key items that drive their financial performance. In this case, it was loans, investments, asset-liability management derivatives, borrowing expenses, and development grants.

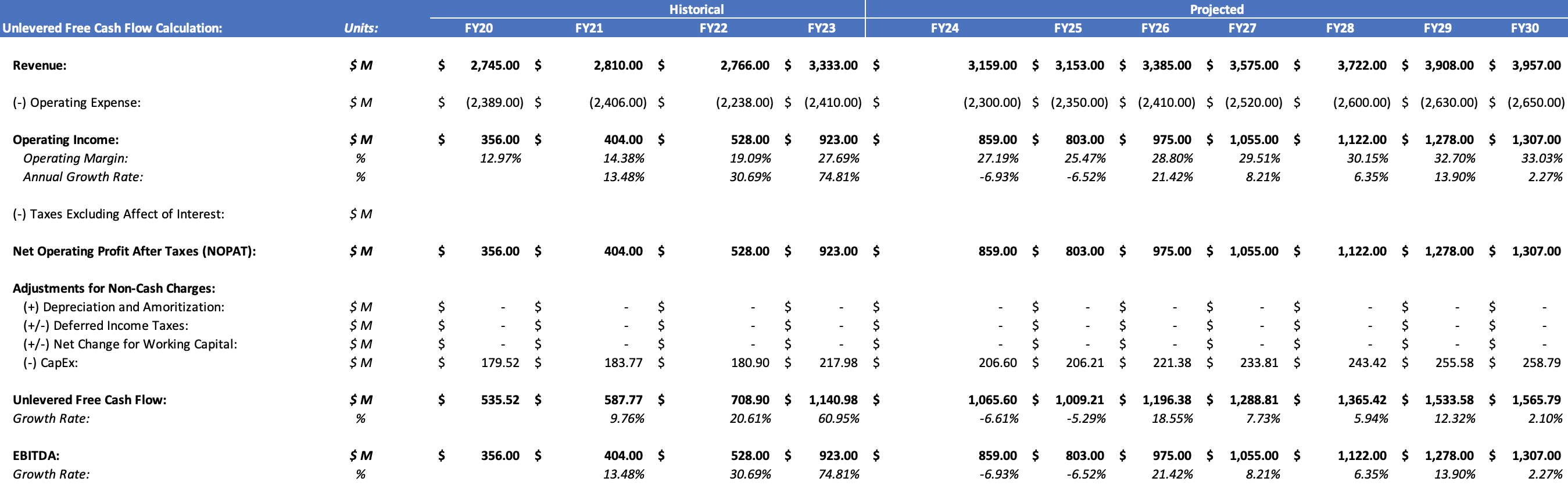

Afterward, I projected the IDA Unlevered Free Cash Flow (UFCF). UFCF is the amount of cash a company has before paying its financial obligations. UFCF is one of the central parts of a DCF because it’s future value is what you discount to the present.

Next, I calculated the Weighted Average Cost of Capital (WACC). WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. In a lot of cases, it is used to assess the “risk of return.” The higher the WACC, the riskier the investment. The lower, the more conservative.

Finally, I calculated the output of the DCF. In most cases, your final output would be the future share price of a company. In the case of the IDA, there are only 174 “shareholders,” which are all the participating member countries. Thus, I calculated the future equity value of the company and divided it by 174 to find the future share price.

As we can see, based on the projections, the IDA’s price per country will grow by 32.13% by 2030. This conclusion is also supported by my other research, which all pointed to the fact that countries, especially in developing regions, are looking for more and more investment from DFIs and MDBs.